Obligations in Colombia for 2024 (Part 1):

1. Submit your income tax return, which deadline begins on August 12, 2024 until October 24, 2024. The submission date depends on the last two digits of your ID. (if applicable)

2. If you have a visa to enter to Colombia, check if you still meet the requirements to maintain the same visa, review the duration of it, among others. (if applicable)

3. If you have foreign investment, money market investment or external debt registered in front of the Colombian Central Bank, review whether you should cancel the exchange statements, replace or change them, depending on whether the conditions of these investments or debts have variations. (if applicable)

This is not legal advice, only general information.

Obligations in Colombia for 2024 (Part 2):

- For those who own real estate:

- Pay the property tax. It must be paid quarterly or semiannually according to the property’s location. Or you can pay in full at the beginning of the year with some discount.

- Pay the property’s utilities monthly.

- Pay the administration bill if the property is located within a condominium.

- Pay monthly the property value appreciation tax. (if applicable)

- For those who own a vehicle:

- Pay the circulation/road tax annually.

- Acquire the mandatory insurance (soat) annually.

- If you wish, you can purchase an additional insurance.

- Check from time to time that you do not have any traffic fine.

This is not legal advice, only general information.

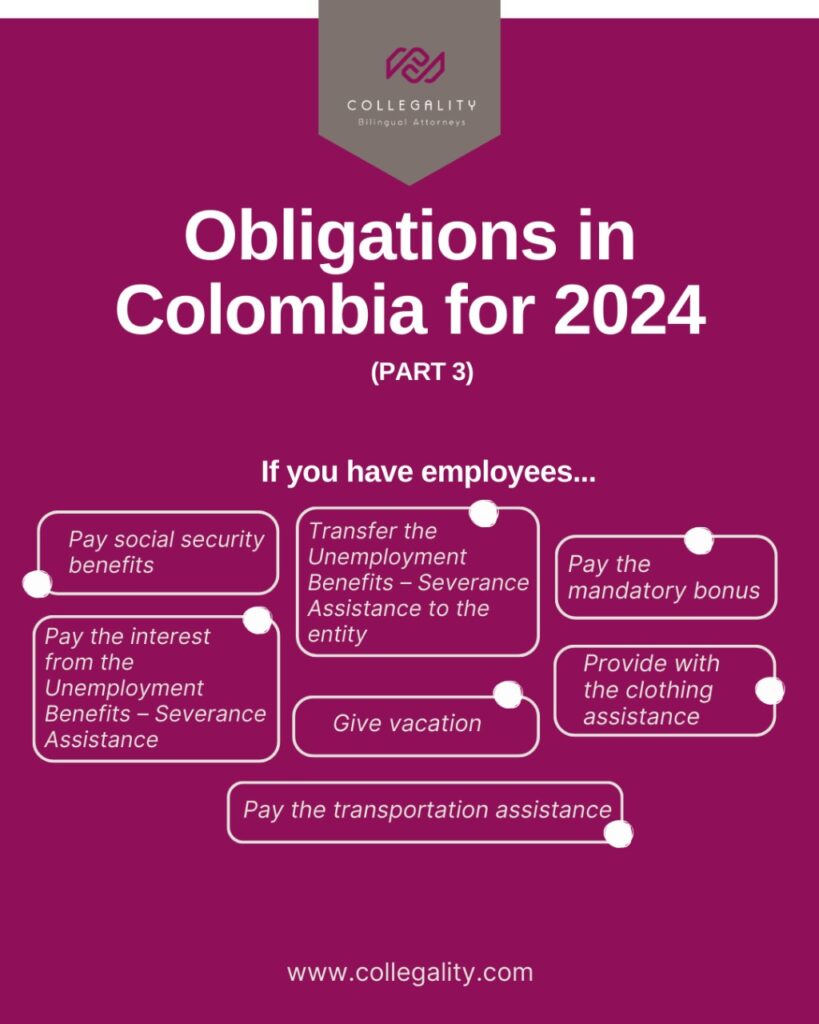

Obligations in Colombia for 2024 (Part 3):

If you have employees:

- Check if the labor conditions are the same or if the contract should be modified.

- Pay the social security benefits monthly.

- Pay the mandatory bonus twice a year, in June no later than the 30th and in December before the 20th (each payment corresponds to half the salary for 180 days worked).

- Transfer the unemployment benefits – severance assistance to the financial entity to which the worker is registered. This payment must be done before February 14th, of the following year.

- Pay the interest from the unemployment benefits – severance assistance in January of the following year worked by the employee. Contrary to the severance assistance, its interests must be paid directly to the employee.

- For employees who earn up to two minimum wages per month, give them the Clothing Assistance three times per year (April 30th, August 31th and December 20th).

- Give vacation corresponding to fifteen business days per year, as long as the employee has worked the entire year.

- Pay the transportation assistance to employees who earn up to two minimum wages per month.

- Depending on the number of workers, review if you must comply with the Sena apprentice quota and occupational health and safety committee, among others.

This is not legal advice, only general information.

Obligations in Colombia for 2024 (Part 4):

If you have contracts with suppliers or lease agreements, check if the conditions have changed, if you must make a change to the contract, if you must send any advance notice, if you must make any increase in the agreed payments, if you must change some dates, if you must renew or modified the insurance policies, among others.

On the contrary, if you intend to terminate the agreement, you must review if you must pay any termination penalty, or if you can notify the termination in advance to avoid said penalty or if you have any valid cause to terminate it.

This is not legal advice, only general information.

Obligations in Colombia for 2024 (Part 5):

If you have a company, you must call and hold the ordinary annual meeting of partners or shareholders, which must be held on the date established in the bylaws or if it is not established, no later than within 3 months following the expiration of each fiscal year, which is generally March 31.

Verify if you should implement SAGRILAFT, the business ethics program and if you should update the database registered in the National Database Registry.

Additionally, review tax obligations such as declaration and payment of value added tax, declaration and payment of withholding tax, declaration and payment of industry and commerce tax, income tax return, and renewal at the chamber of commerce, among others.

If the company has any registration with the Colombian Central Bank, for foreign investment, external debt, compensation accounts or registrations for import or export, review if it is required to make any declaration.

If your company issues securities on the Colombian Stock Market, you will have additional obligations, such as the Country Code and presentation of some reports.

This is not legal advice, only general information.